As scrutiny of ESG claims increases, companies' carbon offsetting commitments may be seen as binding, and companies will take greater care in engaging in environmental asset transactions.

As scrutiny of ESG claims increases, companies' carbon offsetting commitments may be seen as binding, and companies will take greater care in engaging in environmental asset transactions.

At the same time, pressure on companies to adhere to and adopt ESG commitments has continued.

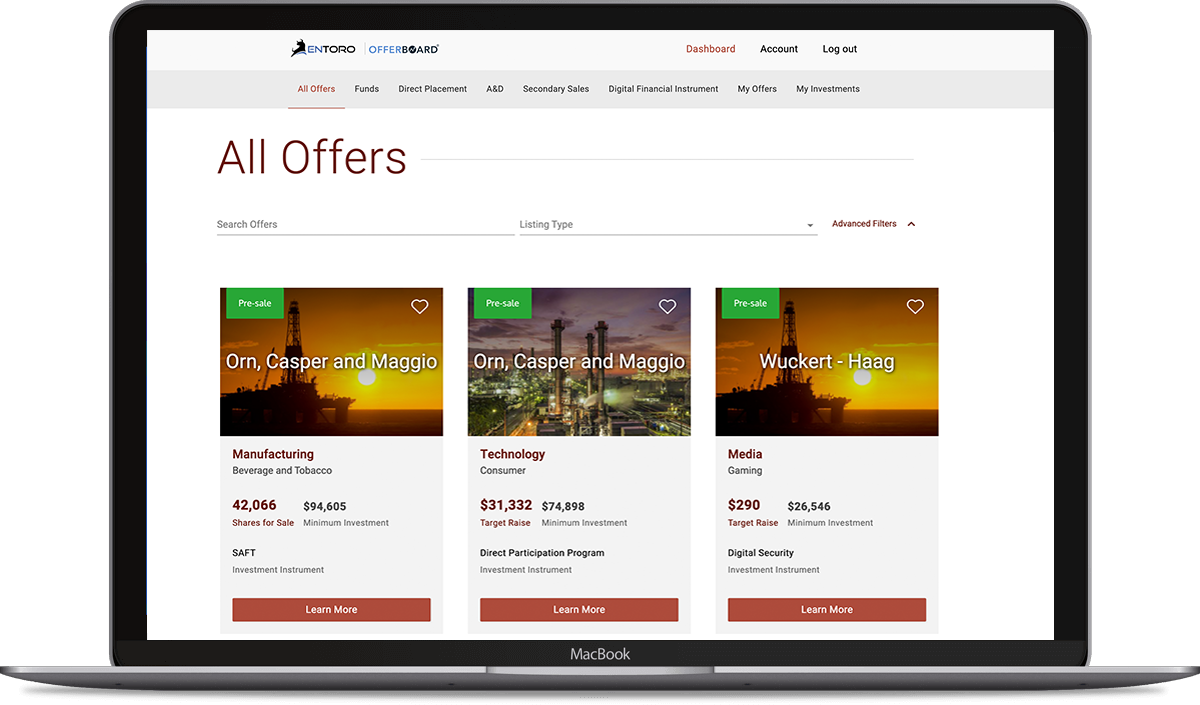

Entoro Eco-Merchants is positioned to take advantage of increased scrutiny and uncertainty by identifying key environmental asset sellers and buyers and connecting supply and demand through strategic brokerage and sales.

Carbon markets are a Wild West with little clarity as to how to identify and safely purchase legitimate carbon offsets.

Our clients benefit from the Entoro Eco-Merchants team's extensive securities and commodities background and access to a range of carbon offset sources through its sister company, Capturiant.

Project Developers should be focused on ensuring the success of their projects, not sales and marketing of their offsets. Entoro Eco-Merchants does the heavy lifting to ensure offsets are sold quickly and at a fair price.

Entoro Eco-Merchants' broad connections with a variety of offset-seeking companies, and access to sister company Capturiant's platform, makes finding buyers quick and easy.